Cargo Insurance—Protect What Moves You

Cargo Insurance

Cargo insurance safeguards your goods—whether by land, sea, or air—against loss, damage, or theft during transit. Furthermore, at F9‑Edge, we offer all-risk plus 10% (CIF +10%) coverage, which means we protect your shipment’s full invoice value, shipping costs, and an extra 10% for contingencies. Consequently, this gives you stronger protection than standard carrier liability coverage.

Types of Coverage We Provide

Our team offers flexible cargo insurance options to match your shipping needs—whether it’s a one-time shipment or regular global transit. Furthermore, each option is designed to provide maximum value for your specific situation..

All-Risk Protection (CIF +10%)

Full coverage with minimal exclusions—ideal for high-value and international shipments. Additionally, this comprehensive protection ensures maximum peace of mind.

Single-Shipment Policy

Pay-per-shipment protection offers perfect flexibility for occasional or one-off cargo moves. As a result, you only pay when you ship.

Open Policy (Annual)

One policy covers all shipments over a set period—ideal for frequent shippers looking to streamline operations. In addition, this approach reduces administrative overhead significantly.

Warehouse-to-Warehouse

Protection starts at your warehouse and ends at the destination warehouse, ensuring no gaps in coverage.

Why You Need Cargo Insurance

Fill Carrier Liability Gaps – Freight carriers and forwarders limit compensation under international rules (e.g., Hague‑Visby, Warsaw). Without cargo insurance, therefore, high-value shipments may be underinsured by thousands.

Cover All Risks – Accidents, weather, fire, handling errors, theft—even jettison or sinking—are included. However, explicitly excluded scenarios are not covered, ensuring clarity in your protection.

Secure Your Supply Chain – Secure Your Supply Chain – Fast-paced logistics rely on certainty. Consequently, insurance ensures losses don’t disrupt business or customer trust, maintaining operational continuity.

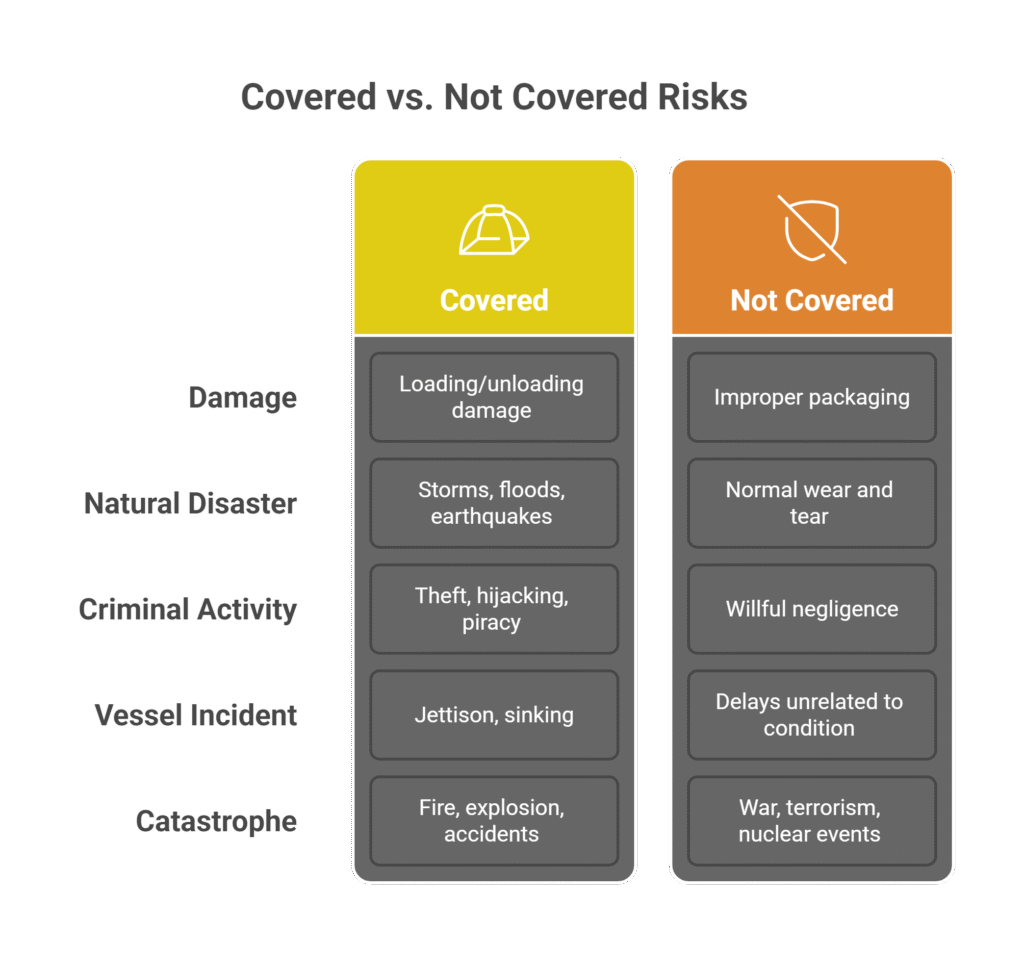

What We Cover—and What We Don’t

Covered:

Loading/unloading damage

Natural disasters: storms, floods, earthquakes

Theft, hijacking, and piracy

Vessel incidents, jettison, and sinking

Additionally, fire, explosion, and accidents

Not Covered:

Improper packaging or willful negligence

Normal wear and tear (e.g., temperature effects)

Delays unrelated to cargo condition

War, terrorism, and nuclear events—unless optional war-risk coverage is added

The F9‑Edge Advantage

- Competitive Pricing – Our scale and trusted underwriters (A+ rating) means you get top-tier coverage at better rates.

- Seamless One-Stop Service – Quote, policy, and claims support—all integrated with your freight services.

- Zero Deductibles on Most Policies – Start claiming without upfront out-of-pocket costs .

- Global Reach, Local Support – International coverage backed by award-winning customer service.

Ready for Worry-Free Shipping?

Protect your goods and your business today. Therefore, don’t wait until it’s too late to secure proper coverage.Get an instant quote or call 505‑308‑2005 | email help@f9edge.com

Your cargo deserves protection that moves as fast as your business